At Takahē Capital, we embrace the power of Trend Following as a systematic strategy that has stood the test of time. However, as with any strategy, scale introduces challenges—particularly regarding capacity limits. For all of our funds, but particularly for the launch of our new high-octane Takahē Global Markets Fund, we’ve designed our approach to ensure we remain agile, diversified, and free from the constraints that hinder larger players in the space.

A recent study by Quantica Capital, “When Trend-Following Hits Capacity – A Case Study on Commodities”, highlights a well-known yet astonishing fact: as Trend Following strategies grow, liquidity constraints force concentration in the most liquid instruments, reducing diversification and ultimately Sharpe ratios. Their findings confirm that a well-diversified commodity trend-following portfolio delivers significantly higher risk-adjusted returns than one constrained by capacity.

For large funds, this presents a real challenge. But for smaller, more nimble managers like us, it’s an opportunity. Being small and trading different markets is an edge. We can operate across a broader range of markets and implement strategies that larger players simply cannot. In particular, we use two key methods to dampen market impact while maintaining diversification and trend exposure:

1. Diversified Entry and Exit Models

While most trend-following models focus on capturing momentum, the way trades are entered and exited can significantly impact capacity constraints. Entries can be smoothed out by adjusting time horizons, model speeds, or entry rules—ensuring that not all orders hit the market simultaneously. Exits, however, tend to be more clustered. When adverse price moves occur, stop-losses across funds are often triggered in sync, creating liquidity crunches.

At Takahē, we employ multiple independent entry and exit models across different timeframes and rulesets. By staggering trade execution and using different model speeds, we spread our impact across different liquidity windows, ensuring that we avoid concentrated exits that exacerbate market pressure.

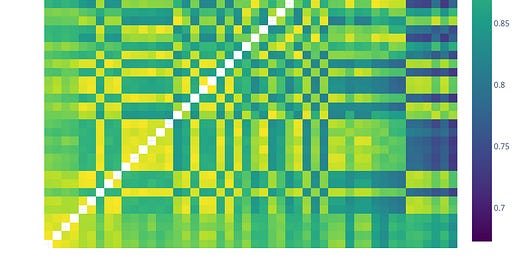

A simple visualization of the return correlation for different parametrizations of the same market illustrates the variation that can be achieved. The distinct groups of correlation in the chart below are the result of:

Shorter/longer lookback windows for the same entry and exit rule.

Slight variations in initial and trailing stop-losses for the same exit rule.

The charts below show the distribution of cumulative performance over time, highlighted by the interquartile range, as well as the best and worst strategy performance across different time periods. Using the same model across different parametrizations, as we did in this example, would ultimately produce similar results. However, it can still reduce correlation and lead to more distributed entries and exits.

2. Trading the Same Market Differently

At Takahē, we like to say that “markets are bound at the hip.” This concept, similar to the classic drunkard-and-dog co-integration analogy, applies directly to futures markets.

Imagine a drunk man walking randomly down a street with his dog on a leash. The man (representing one market or contract) stumbles around unpredictably, taking steps in different directions. The dog (representing another market or contract) also moves unpredictably but is always tethered to the man by the leash. While the two may drift apart at times, they cannot stray too far from each other before being pulled back into proximity.

In financial terms, this describes co-integration—where two assets (or in this case, different futures contract expiries) may fluctuate independently in the short term but maintain a long-term relationship.

Many Trend Following programs define a market as its front-month futures contract or the most liquid contract rolled on a set schedule. However, the entire futures curve represents a connected set of tradable opportunities. The different expiries, though exhibiting distinct behaviors at times, are all fundamentally anchored to the same underlying asset and tend to be highly correlated over time. This creates two major advantages:

Increased diversification – While the front-month contract is the most liquid, further-out contracts can behave differently at times, offering additional return streams.

Reduced market impact – Instead of concentrating liquidity needs in a single contract, we treat each of these constructed markets with different rolls as a separate, standalone entity. By structuring our execution this way, we avoid crowding into a single expiry and can spread our exposure across multiple contracts.

Below is an example of RBOB Gasoline Futures rolled according to two different schedules and holding different (liquid) contracts on the curve. While both markets sometimes drift apart, there is a high degree of co-movement between them and they tend to be closely correlated.

Of course, when trading these highly correlated pairs, it’s crucial to think about risk management and position sizing. Should each contract be treated as a fully independent market, or should position sizes be adjusted to reflect their correlation? The answer depends on the strategy’s objectives, the instrument's nature, and the liquidity profile of the different expiries. Thoughtful sizing ensures that we maintain diversification without inadvertently doubling risk in highly correlated positions.

The Advantage of Being Small & Nimble

The Quantica study confirms what many in our space have long suspected: as funds grow beyond a certain point, liquidity constraints force suboptimal allocations, reducing both Sharpe ratios and diversification. At Takahē Capital, we turn this insight into an advantage.

By staying nimble and highly diversified, we avoid the pitfalls of larger, more capacity-constrained players.

By implementing diversified entry and exit models and trading across futures expiries, we maximize our ability to capture trends while minimizing market impact.

And most importantly, we align our interests with our investors by charging no management fee—only performance-based compensation. This ensures that we remain incentivized to generate real, sustainable returns.

The bottom line? Trend Following works—but only if it’s done right. We believe that by maintaining a lean, diversified, and flexible approach, Takahē Capital is uniquely positioned to thrive in a space where bigger players face growing constraints.

For those interested in a modern, high-performance approach to systematic trading, we’d love to connect. Let’s keep the conversation going!