Schrödinger’s Macro Lens #2

Energy Awakens, Crypto Stirs

If last week was all about Gold’s hesitation, this week it’s Energy’s turn to shine. Schrödinger added XLE to the Alive list, a clear sign that the model’s analogues now recognize improving conditions in the energy complex.

Demand for power is surging, utilities are scrambling, and tech giants are building data centers next to nuclear plants. In the background, AI is consuming electricity like never before.

U.S. utilities are seeing explosive electricity demand from data centers — in some cases, new requests exceed the entire load of a utility’s existing customers. Reuters

In PJM, data center load drove ~82% of the jump in capacity auction revenues, signaling real supply stress. utilitydive.com

Energy companies are pouring capital into power plants and grid upgrades to feed AI/digital infrastructure demand. World Economic Forum

The IEA forecasts that electricity demand from data centers will more than double by 2030, largely due to AI expansion. IEA+1

Utilities like PG&E plan $73B upgrades through 2030 to handle surging demand from tech infrastructure. Reuters

These aren’t isolated anecdotes, they’re structural tailwinds.

Factor context matters

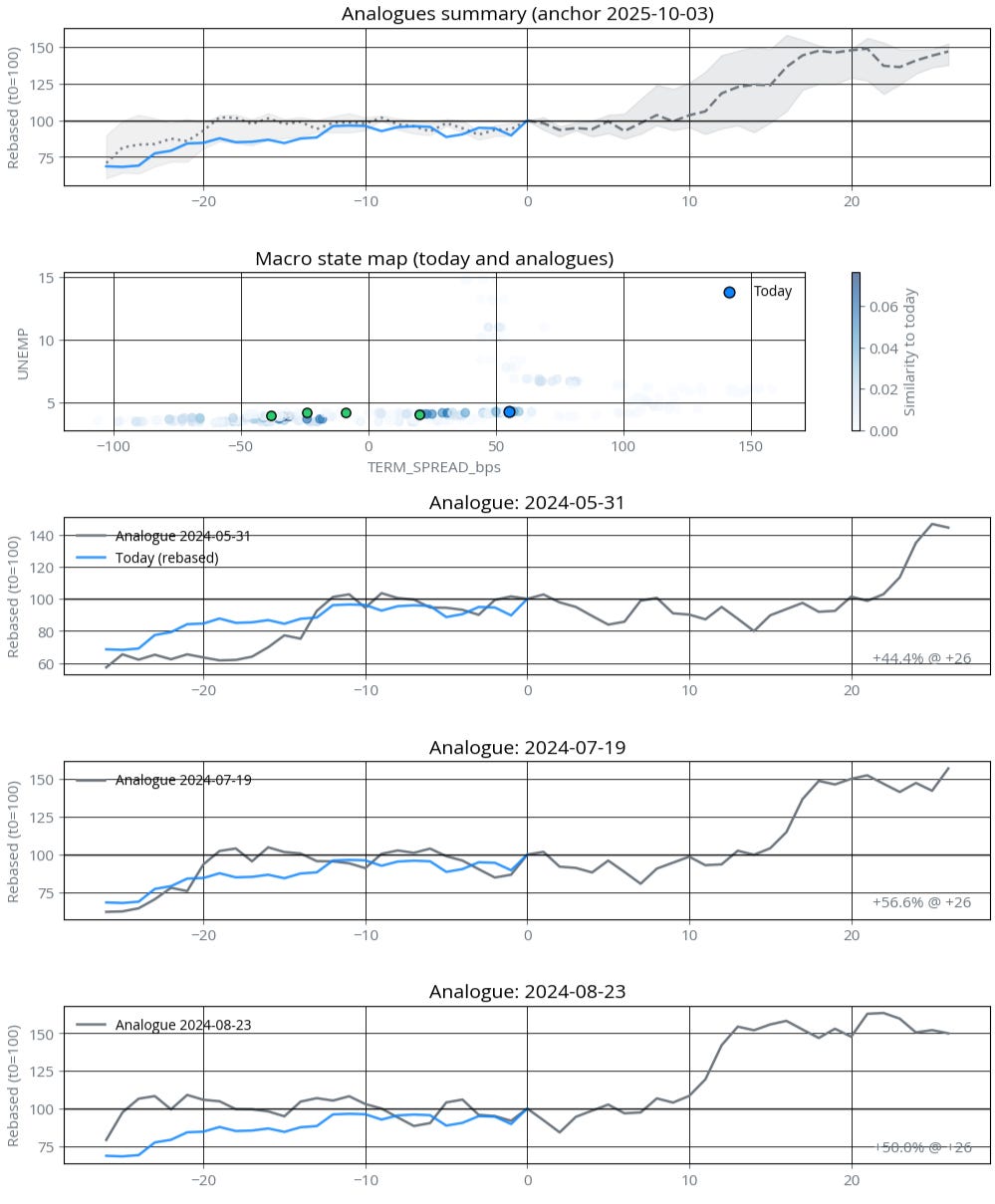

This week, the model’s internal balance tilted 60% price, 40% macro. The single strongest factor? Short-term momentum. Energy has already broken out.

On the macro side, term spread (10y – 2y) remains the dominant driver. A positively sloped curve, now re-steepened, tends historically to favor cyclical sectors, especially those tied to infrastructure and industrial growth, like energy.

In short: energy wins at the intersection of technological demand (AI, data centers) and macro regime (normalizing yield curve).

Meanwhile in Crypto Land

While Energy lit up, the cat’s other paw is cautiously reaching back into crypto.

For the first time in weeks, Bitcoin (IBIT) moved back to Alive status, small weight, but symbolically important.

The model expects the real rally in BTC to kick in around 10–12 weeks from now. The most important historical analogues it’s referencing are from Q3–Q4 2024, a period that also saw renewed optimism into year-end, eerily similar to current market sentiment.

Altcoins, however, remain mostly muted: DOGE and XRP have turned Dead, while HYPE continues to top the 4–12 week forward return leaderboard at +29%, nearly unchanged from last week.

Short-Term Favorites

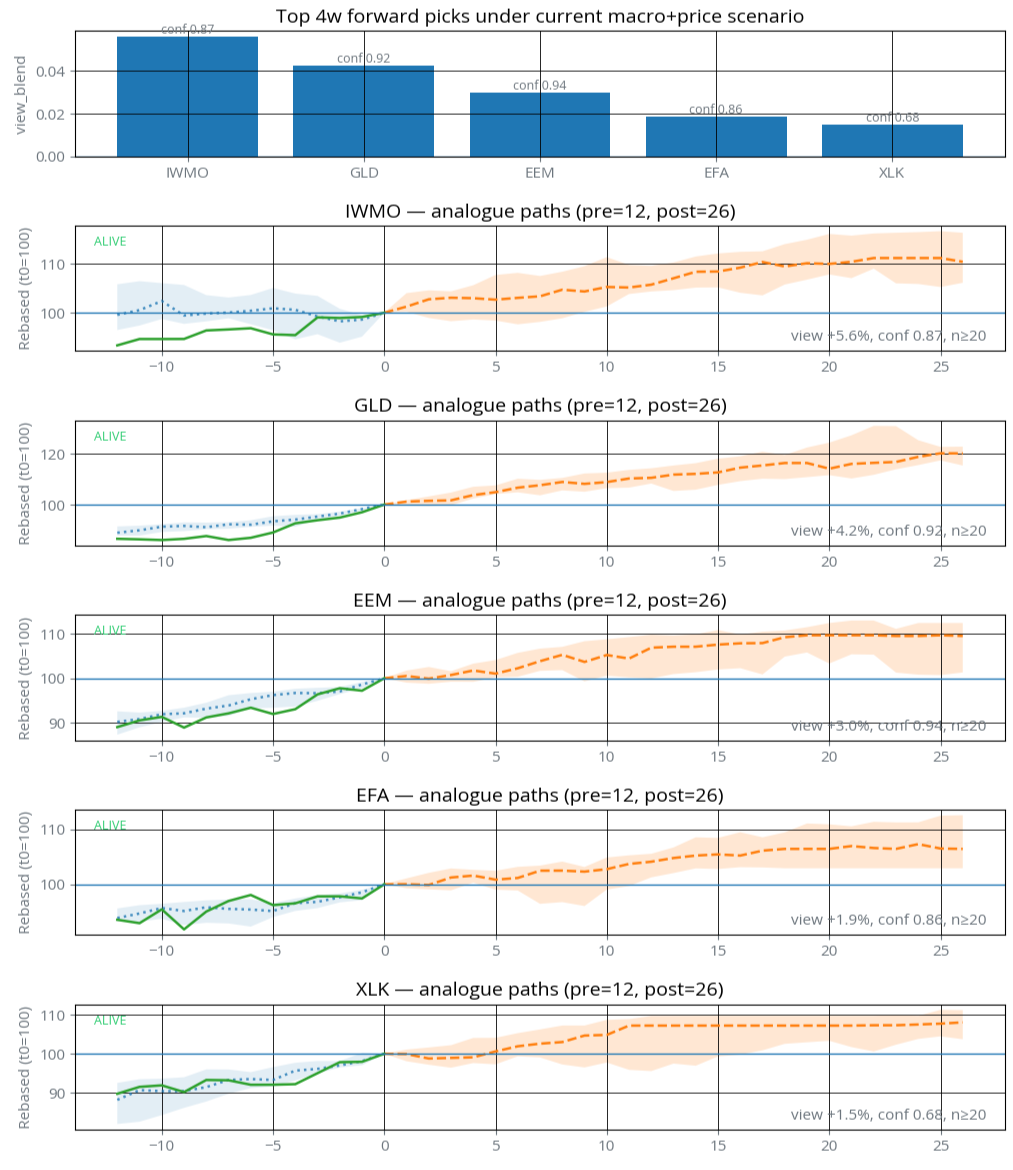

On the 4-week horizon, if we let the cat choose freely, its top picks would be:

IWMO (momentum equities), GLD (gold), EEM (emerging markets), EFA (developed markets ex-US), and XLK (technology).

Note that the live ETF portfolio blends several horizons (4, 8, 12 weeks). So while short-term favorites may not appear in the allocation directly, they influence positioning through the ensemble.

The Bigger Picture

Last week’s performance was mildly positive (~0.8%), but that’s less interesting than the why.

Schrödinger continues to favor defensives with selective risk-taking, a mix of bonds, energy, and global momentum equities, while staying skeptical toward U.S. growth and speculative corners.

If Energy is the story of real power and infrastructure, and Bitcoin the story of digital scarcity, then this week’s allocation says one thing clearly:

The next phase of the cycle runs on both electricity and belief.

Love this!