Same Coin, Different Headlines

When 100k isn’t your number

In early July, BTC/USD headlines screamed:

Bitcoin smashes $100,000!

Now racing toward $120k!

Meanwhile, in Europe, we saw the breakout too, just not at the same big round numbers.

BTC/EUR had already been climbing, but from our vantage point the trend was more muted.

It’s a small reminder: the market you look at depends on the currency you live in. That doesn’t just change how exciting the headlines feel, it can actually change the trading signals you generate.

Just for fun, what if we traded Bitcoin like a true Europoor, taking BTC/EUR trades based on BTC/USD signals? Would it make us richer? Or is it just a psychological crutch so we can pretend we’re riding the same glorious moon-shot our USD-based peers keep bragging about?

Not Just a Bitcoin Thing

This isn’t unique to Bitcoin. Any asset quoted in a currency you can translate into your base currency has two parallel price histories:

One in the market’s native quote currency

One in your base currency, adjusted through the FX rate

If you’re holding the asset unhedged, both matter. And your signal generation depends on which of those price series you feed into your model. That choice can matter more than you think.

The Experiment

We kept it simple:

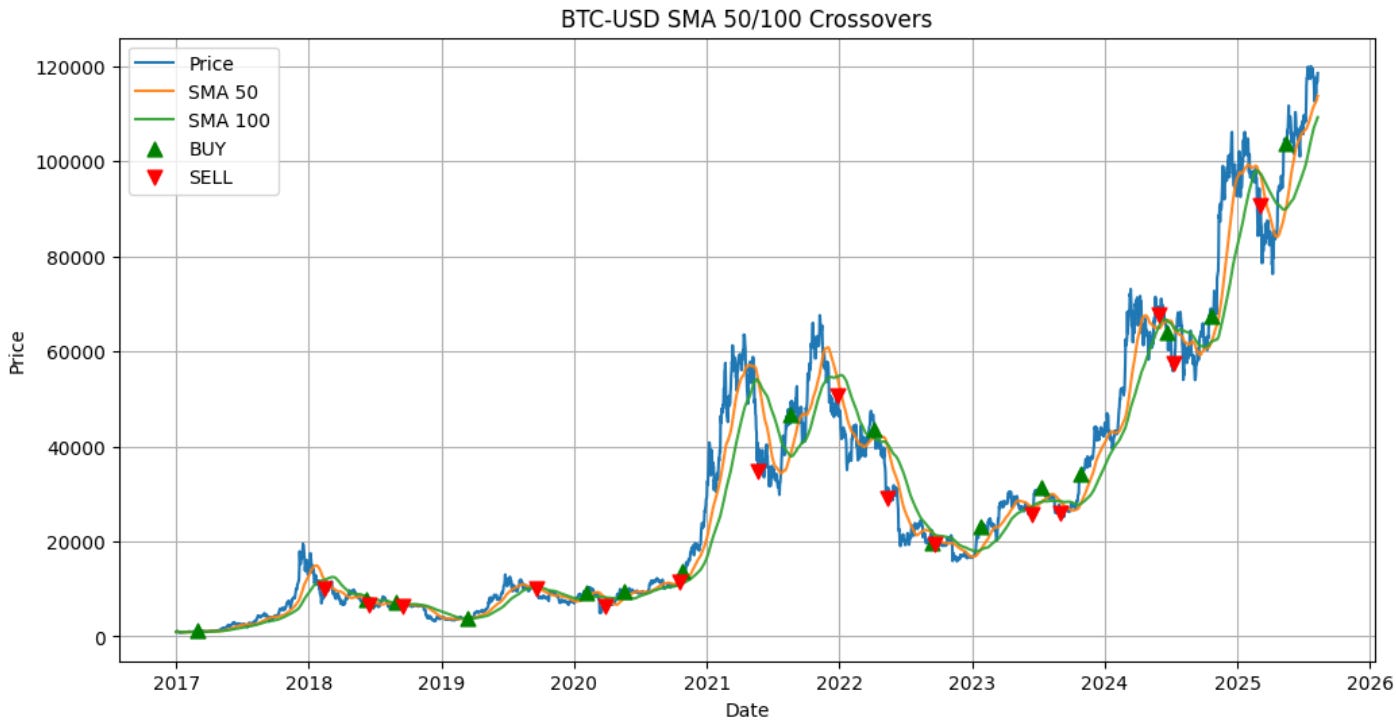

Signal 1: 50/100-day SMA crossover on BTC/USD.

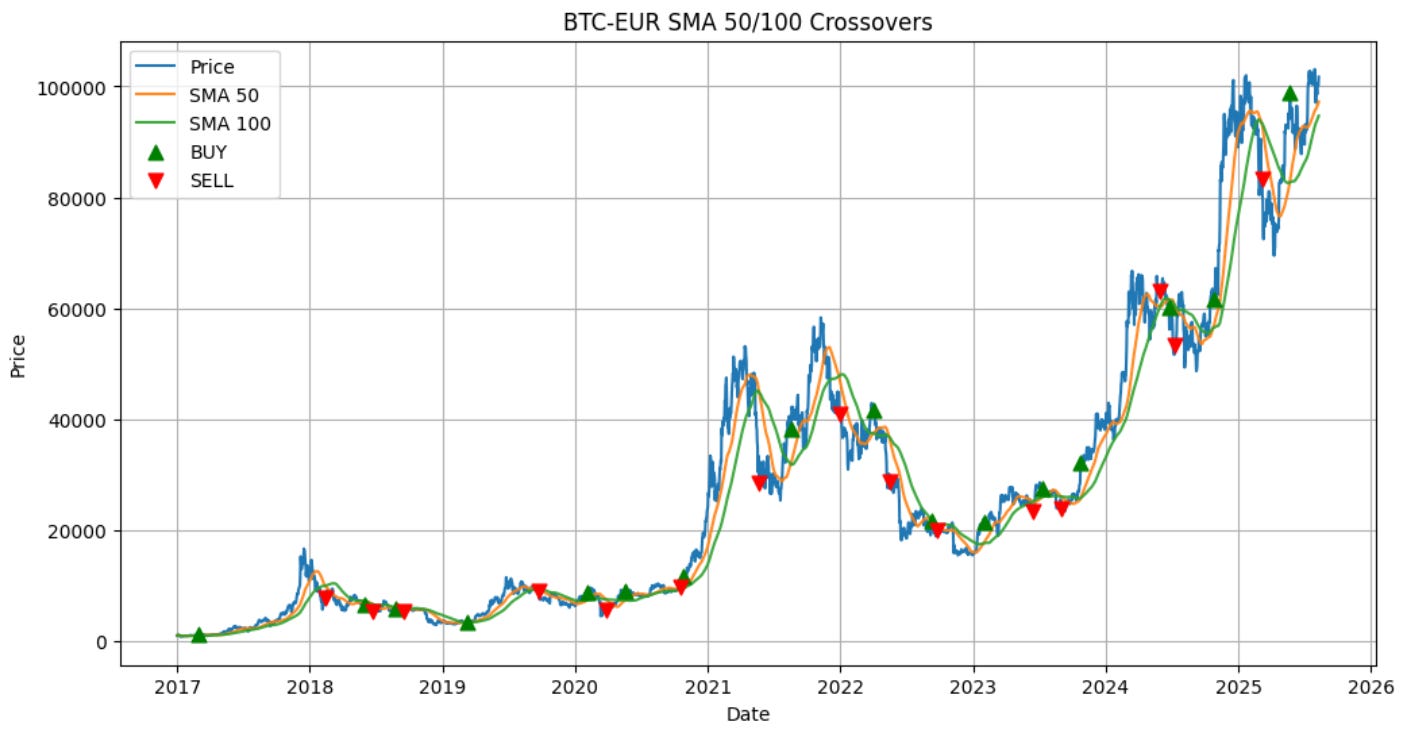

Signal 2: 50/100-day SMA crossover on BTC/EUR.

Apply both signals to trade BTC/USD.

Apply both signals to trade BTC/EUR.

We also allowed a ±3-day tolerance when comparing the signals to avoid overcounting tiny timing shifts. Even then, the two series only disagreed on ~15 trades across the entire sample.

At first glance, the buy/sell signals for both series look pretty similar.

BTC/USD:

BTC/EUR:

Surely, with so few differences, the performance wouldn’t change much … right?

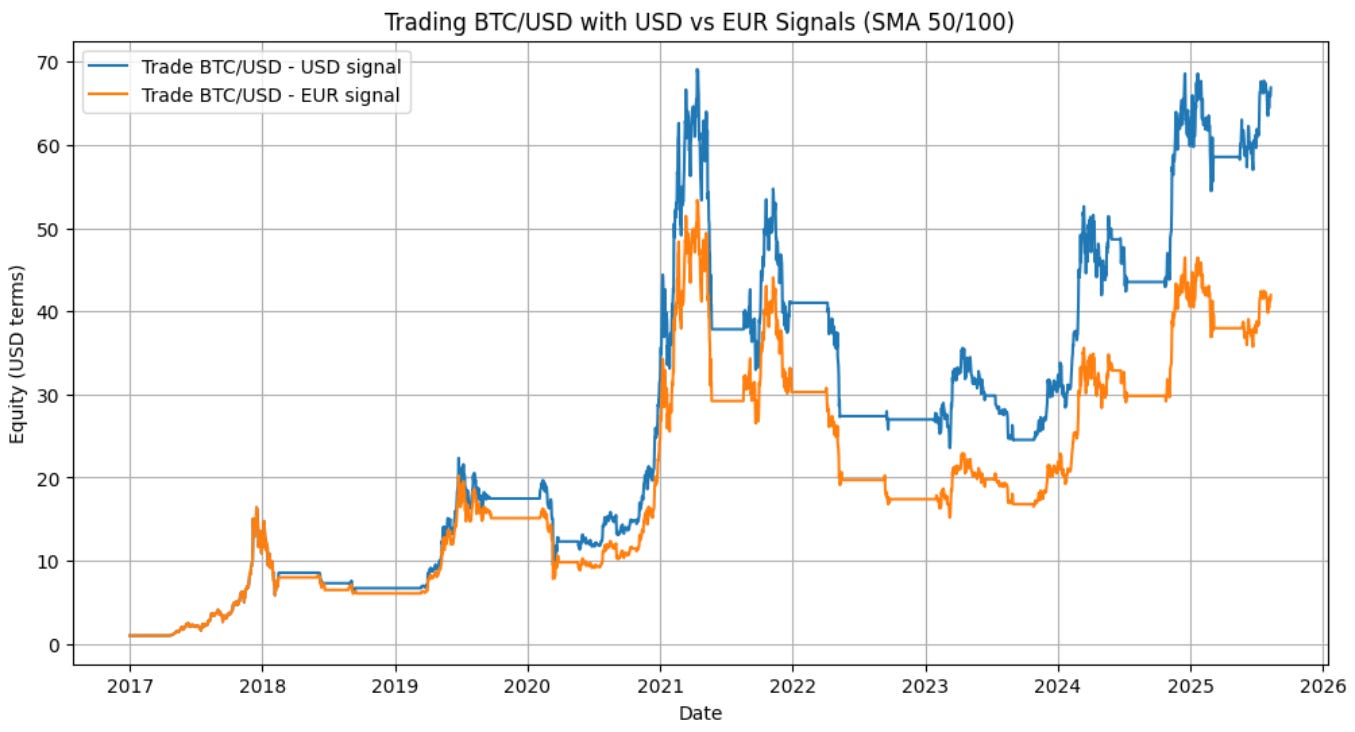

Trading BTC/USD with Both Signals

When trading BTC/USD, the USD-based signal outperformed the EUR-based signal. The curves track closely in the beginning, but divergences show over time. Since we normally calculate signals in the native currency of the instrument we trade, it’s reaffirming to see the “correct” signal also delivering the superior result.

So, what happens if we flip it and use the USD based signal to trade BTC/EUR?

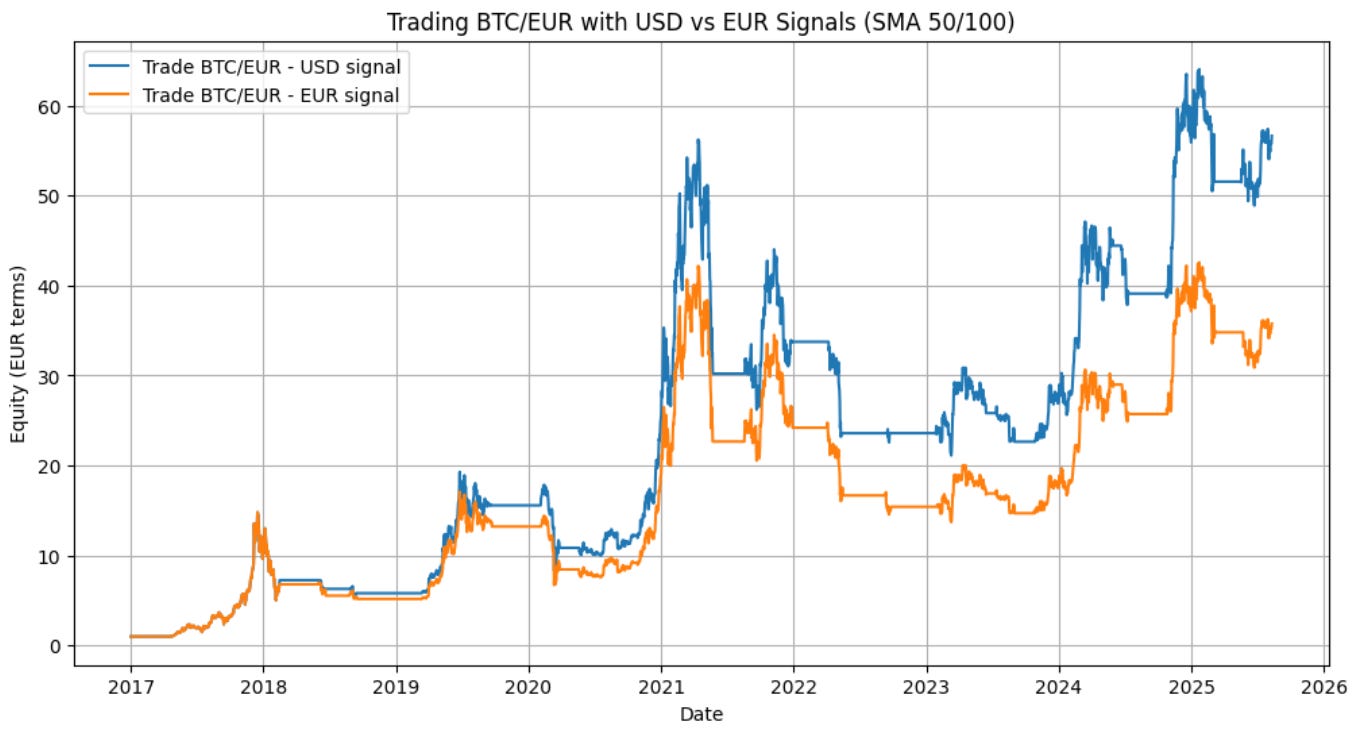

Trading BTC/EUR with Both Signals

Here’s the twist: trading BTC/EUR with the BTC/USD signal actually outperformed trading BTC/EUR with its own BTC/EUR signal. Those 15 differences weren’t spread evenly, a few landed at pivotal points, catching or missing large moves.

The result? The “wrong” signal delivered better results for this period.

Why This Happens

The most recent differences were amplified by the USD trending lower since Trump’s “Liberation Day” announcement in April. As the dollar weakened, BTC/EUR got an extra lift even when BTC/USD was moving sideways. That extra push in EUR terms meant some moving average crossovers happened earlier or later than in USD terms.

If those shifts happen to align with large price moves, they can outweigh the “currency fit” advantage. However, it’s not just a recent quirk. EUR/USD moves over the entire sample contribute to the divergence. Those small differences compound over time, subtly reshaping where and when your signals trigger.

If you fix the signal (for example, use BTC/USD signals for both markets), then the performance difference is purely the EUR/USD trend working for or against you. But when each market generates its own signals, the EUR/USD component can also change the timing of those signals and it’s that extra timing divergence that can have an outsized impact on results.

The Moral of the Trade

So what’s the moral of the story? If you hold a fully funded position, the currency you choose for your signals really does matter. When your reporting currency differs from the instrument’s native quote, FX moves are baked straight into the price series, quietly shifting your entries, exits, and ultimately your PnL path.

Even small timing differences can snowball if they show up at just the right (or wrong) moments. Sometimes those shifts help you. Sometimes they don’t. And while the futures crowd can mostly ignore this little wrinkle, that’s a story for another day.

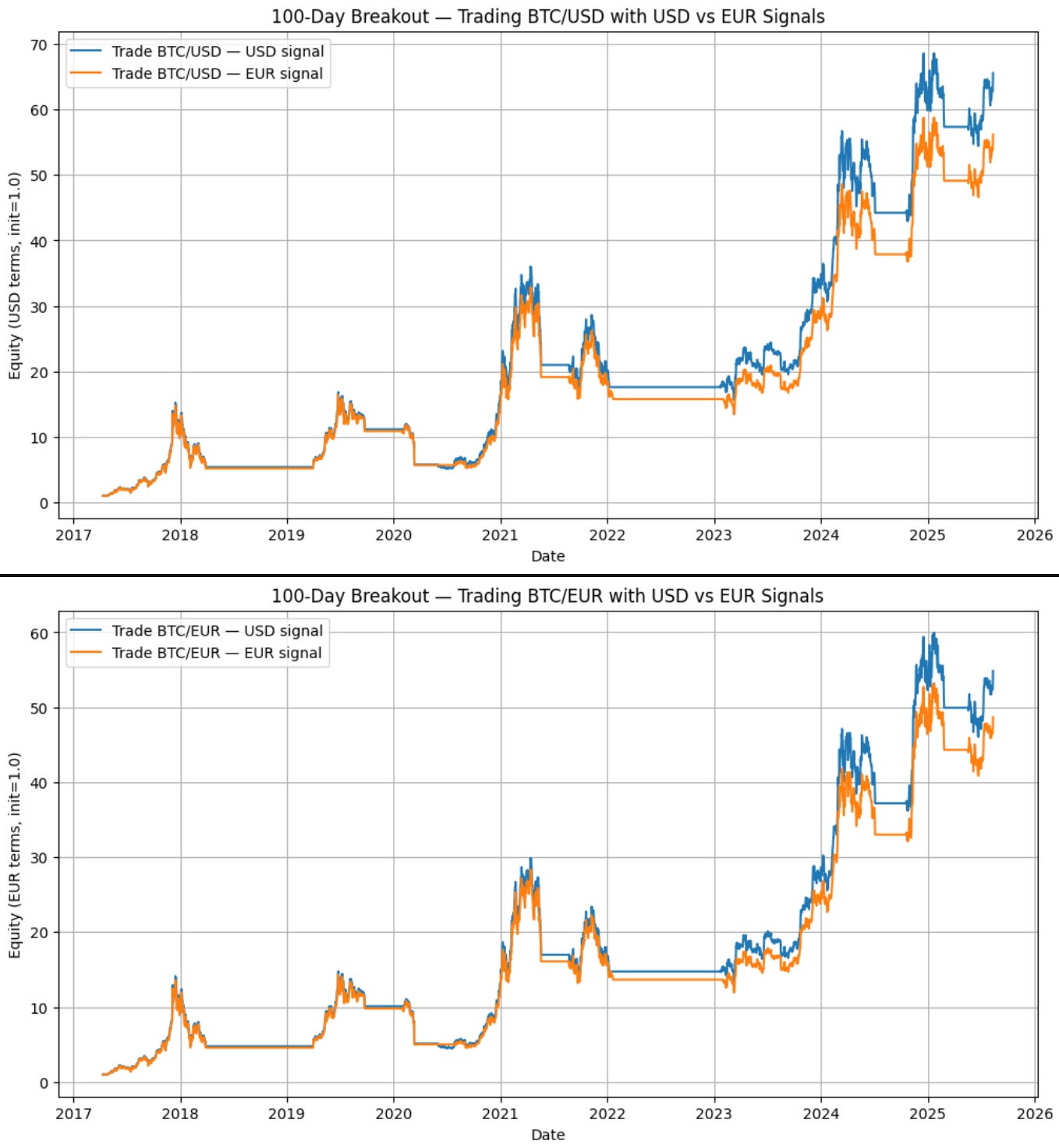

Bonus:

The same holds if you swap out the SMA crossover for a breakout signal. Even with just 8 mismatches within a ±3-day window, you still see differences. The effect is a bit less dramatic here, partly because breakouts are fewer in number and match more closely.

That’s the nature of the beast: you are not taking a derivative of price (like comparing two SMAs), but using pure price as the trigger, which tends to make the signal more robust.

The good news? It does not matter whether you are a US investor or a Europoor. In both cases, the most recent breakout fired off a successful long entry.

I always wondered about this. Thanks for filling in this hole in my understanding of global trading.