Of course, the topic du jour in systematic circles is the recent tariff-related market drop, and how trend-followers navigated it.

Some have struggled. The SG CTA Index is down -6.48% month-to-date, and dispersion across managers is unusually wide — at least, that’s the word on the street. As markets whip back and forth between policy uncertainty, weak breadth, and shifting macro narratives, it’s no surprise that some trend strategies have found themselves offside.

But if you look beneath the surface, there's something else going on. Something constructive.

We're seeing signs that trend-following strategies are repositioning — and that a new regime may be setting in.

We haven’t been immune to the whipsaw — but what we’re seeing now is a meaningful repositioning across the space. Many trend systems have flushed out legacy exposures and are starting to lean into emerging directional themes. We're seeing trends develop in areas like long gold, short energy, and long CHF and EUR, with equity exposures (e.g., short NASDAQ and Euro Stoxx 50) starting to build, albeit more selectively.

What the data shows

At Takahē, we recently ran a study on how trend-following strategies perform around volatility events.

Using VIX data going back to 2001, we classified market environments into high and low volatility regimes using the 75th and 25th percentiles of median monthly VIX. Then we looked at how trend-following strategies performed after those volatility events, separating funds into medium and high volatility groups based on realized vol. Medium vol funds are those averaging a long term vol of around 15% to 20%, while high vol funds are mostly at 25% and above.

Our sample included 10 long-running pure trend-following funds, representing a mix of large institutional managers and smaller, more specialized programs — each with a long enough track record to observe consistent behavior across multiple cycles.

And while this is hardly a rigorous statistical paper, it gives us a compelling directional signal on how volatility regimes impact forward trend returns.

First, the famous econometric method: eyeballing

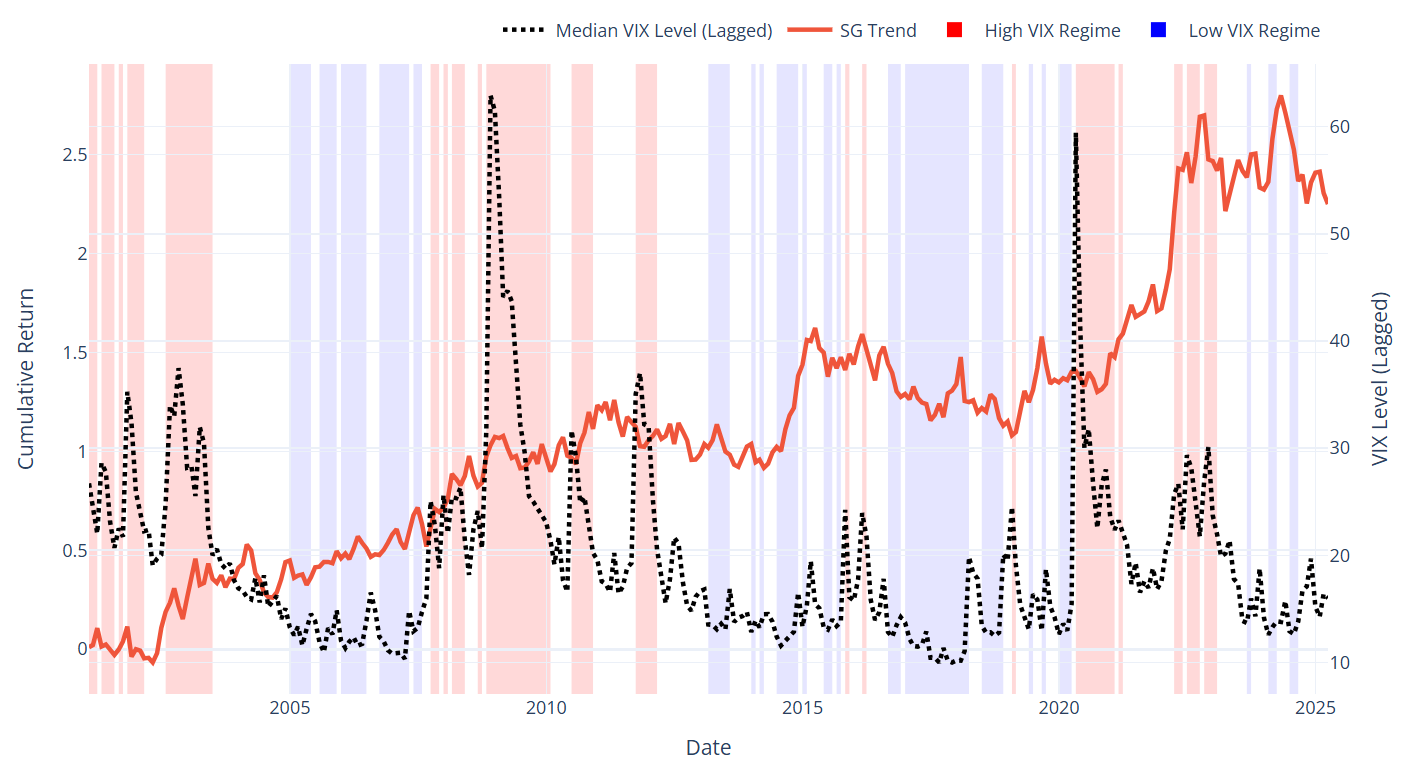

We started by plotting the SG Trend Index against VIX, with high- and low-volatility months shaded.

The chart tells a familiar story. You can spot nearly every major regime shift:

Dot-com crash

Global Financial Crisis

Flash crash (2010)

U.S. downgrade (2011)

August 2015 (pre-Fed rate hike panic)

COVID shock in 2020

The inflation-driven 2022 spike

Interestingly, “Volmageddon” in February 2018 doesn’t show up as high volatility here — because we use monthly medians, and that spike was incredibly short-lived. That in itself is telling: a sharp spike isn't always a structural volatility regime shift.

The takeaway? Trend often finds its footing in the aftermath of volatility.

Then we looked at the numbers

This is just a quick analysis — but an interesting one.

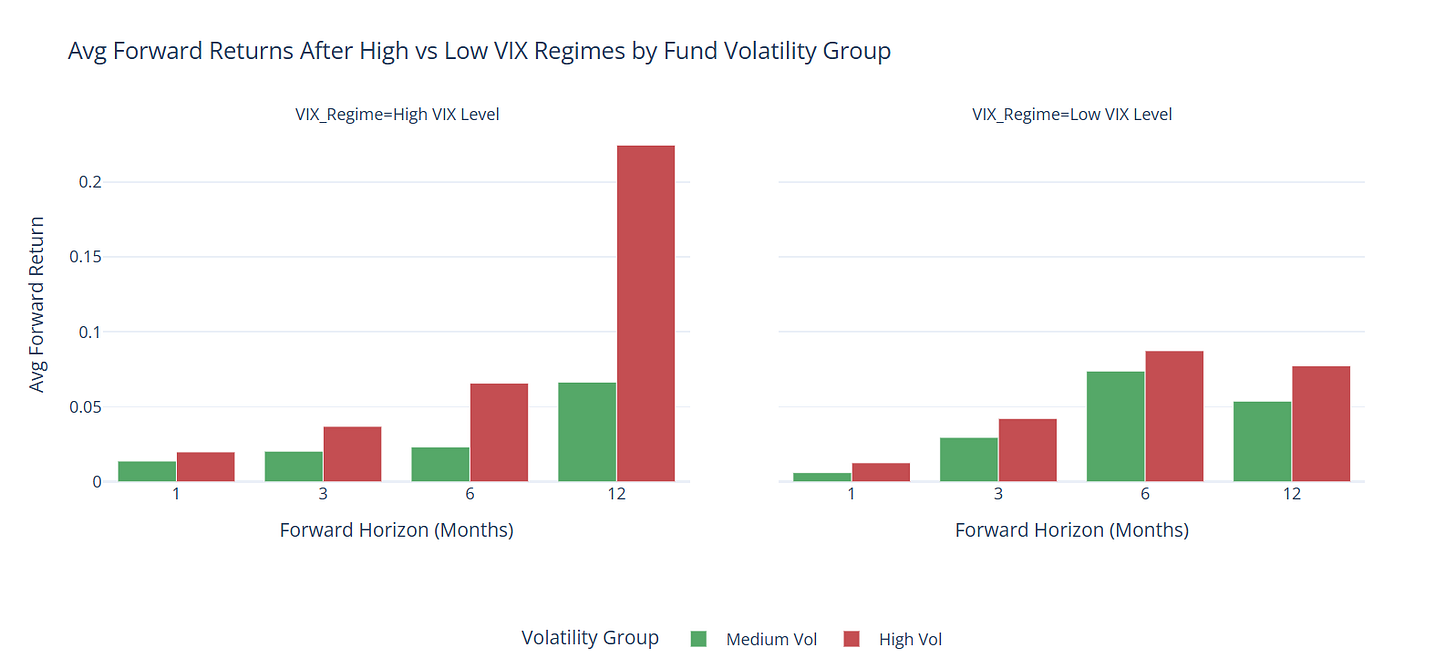

We broke out the average forward returns over 1, 3, 6 and 12 months of trend-following funds after high vs low VIX regimes, split by fund volatility group (medium vs high realized vol).

Here’s what stood out:

High-volatility trend funds outperformed medium-volatility trend funds in both regimes. In high VIX regimes, the outperformance is especially visible on the 12-month horizon.

Medium-volatility trend funds performed better in low-volatility regimes than in high-volatility regimes, except at the 12-month horizon, where that relationship reverses.

Notably, at the 12-month horizon, the return difference between high and low VIX regimes for high-vol funds was three times larger.

This pattern hints at something structural: higher-vol strategies may be better positioned to capitalize when directional moves persist after a volatility event — even if they don’t always shine in the immediate aftermath.

So why might high-vol outperform?

These strategies are often:

Willing to let winners run without trimming for volatility

Comfortable holding positions through noisy, high-vol environments

Built to ride the full trend, not smooth every bump

In contrast, lower-vol funds may reduce exposure or scale back risk during volatile periods — which can mean missing the meat of the move when a new trend takes hold.

So no, high-vol funds don’t adjust quicker.

They simply stay in the fight.

They’re not faster. They’re just less scared of volatility.

And when the dust settles, that conviction often pays off.

The inflection point

Systematic trend is designed to adapt, not predict.

It often lags at turning points, but tends to thrive in persistent regimes.

After a period of drawdowns and reversals, we may now be entering one of those persistent regimes — with cleaner positioning, rising dispersion across assets, and macro catalysts building beneath the surface.

This feels like a classic reset. I'm not calling the next crisis — but historically, these mid-cycle clean slates have been some of the best times to invest in trend-following.

Not because the future is guaranteed, but because the slate is clean, positioning is light, and the opportunity set is starting to re-expand across asset classes.

Launching May 1st: Takahē Capital Global Markets Fund

At Takahē Capital, we believe in a high-volatility, high-conviction approach to trend.

No dilution. No smoothing. Just a disciplined, diversified system designed to outlier moves and compound over time.

Inspired by the comeback of the flightless Takahē bird, our fund is built to soar in volatile environments — not shy away from them.

If you're an accredited investor and want to learn more ahead of our May 1st, 2025 launch, reach out to us directly:

📩 contact@takahe.capital

🔒 www.takahe.capital