The world and the markets are far more random than we’d like to think and can imagine. From a statistical perspective, market risks tend to be concentrated in rare but extreme market events which are impossible to predict. Black Monday 1987, negative oil prices, the stock prices of Lehman Brothers or GameStop – the list goes on. All of these are outliers.

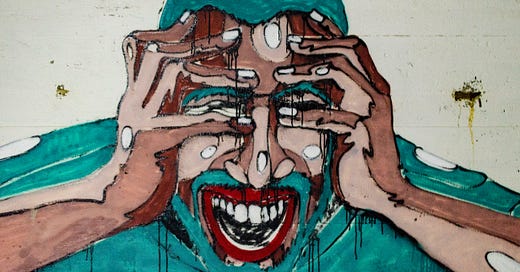

We think it’s prudent and necessary to accept volatility and drawdowns rather than following an investment approach that seeks to achieve the opposite but is hazardous to our capital. It’s a form of pain arbitrage, and in order to execute this arbitrage, we need to adopt the mindset of a professional loser. That is, accept a lot of small and somewhat painful losing trades in a process that swaps return-smoothness for resilience and attractive long-term gains.

A painkiller, but not a risk-killer, is to invest in illiquid funds which don’t mark-to-market. You’ll have less pain because the daily return randomness remains hidden from sight. However, it does not mean that you’ll have less risk. It might just be an expensive placebo. Cliff Asness aptly calls it “volatility laundering.”

How can we put volatility into perspective and avoid getting confused?

Imagine an investment that generates 15% annualized returns with 10% volatility – a superstar Sharpe ratio of 1.5. Using Gaussian statistics, this means that the probability of making a gain in a random year is 93%. However, when we reduce this time horizon down to a single month, this probability drops to 67%.

Now consider a more realistic yet still very attractive Sharpe ratio of 0.8 based on a 20% p.a. return with 25% volatility. The probability of achieving a positive return in any random month is now 59%, and any time horizon shorter than that isn’t much better than 50:50 coin toss.

These numbers include some important facts which I believe you should be aware of when investing in funds or other investment products:

It may take much longer than you think for your investment to make money – even in the case of an investment with a Sharpe ratio of 0.8. Statistical edges require time and sample size to shine through. Investors therefore need a long-term time horizon for their investment.

This in turn requires patience as well as the endurance of some pain as the investment deals with the daily market risks while being on a path to its long-term expected return.

Investors who shorten their time-horizon in response to volatility and drawdown tend to underperform as they end up chasing returns. Mean regression is a fact and not a fantasy.

Double-digit monthly returns, both up and down, are not a sign of product failure if the fund’s aim is to earn more than 20% per year.

Investing isn’t a beauty contest.

Happy Trading & Happy New Year!