Keep Calm and Carry On

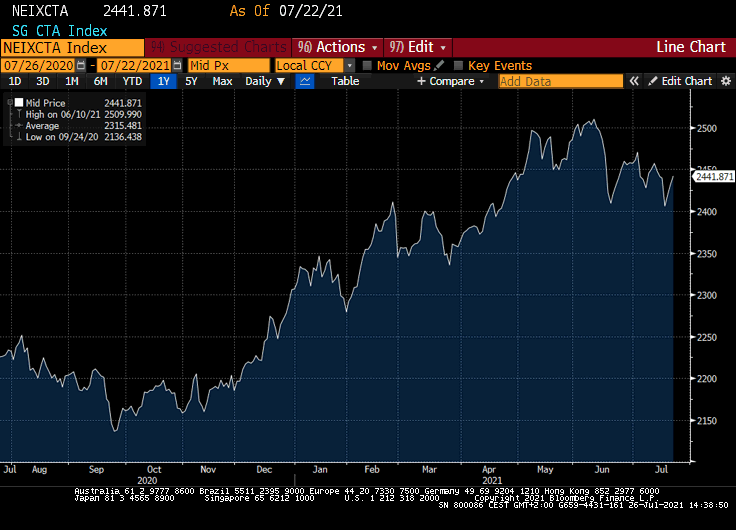

Thus far 2021 has been a great year for systematic trend following traders. Although there’s been some PL giveback in the past two months, the SG Trend Index (Bloomberg: NEIXCTAT Index) has managed to make a new all time high in June (see chart below).

Many of the markets traded by CTAs have also reached new highs recently. Equities are on a one-way street higher. Natural gas and coffee look bullish, as do iron ore, copper, and crude oil. All onward and upward.

Unsurprisingly, many people think market all-time highs can only mean one thing: expensive. Which in turn means that one should sell (rather than keep or add to the position).

Nothing could be further from the truth, but it’s very easy to have that viewpoint. It’s like an itch we want to scratch. An almost irresistible urge to exit profitable positions although the longer-term trends are still in play.

Avoid that mousetrap. You surely don’t want to miss out on these great uptrends only because you subjectively believe the markets to be too expensive. Even if markets are in a bubble, your position should be long until your exit is hit. That’s all there is. That’s the rule. Nobody knows what the markets will do and where prices will be tomorrow, next week, next month, or next year.

To help you stay the course, I’d like to share some of my personal trading principles with you today. They are very useful to me, and I hope they’re valuable to you, too.

#happytrading

Don’t follow other peoples’ decision-making process.

Ignore broker recommendations.

Fade the fundamental market analysis.

Never get married to a position. Be ready to exit at all times. No regrets.

Losses are an inevitable part of the trading game. Accept them, but keep them small. Always small.

Never double down on losing trades.

Have a trading plan. A system. A set of robust rules.

Don’t rush into trades. The markets will be there for you tomorrow.

Don’t fall in love with yourself when you are winning, or become depressed when you are losing. Stay balanced (sports, vacation, reading).

Backtest your rules before you risk any money. Only risk your money when you have an edge.

Forget paper trading. It does not work.

Focus on your long-run goal and let the compounding do its magic.

When you’re in doubt or have questions, speak to friends or other traders.

Never trade too large. Positions should be sized “just right” and no single position should ever dominate your portfolio.

Markets can go much higher than you think, and much lower than you’d ever believe possible. Markets are full of surprises.

Nobody has a crystal ball and nobody knows the future. Trading is a game of probabilities, not certainties. It’s a sequence of well-sized bets.

Don’t watch the screens all day long. It’s an unnecessary distraction.

Develop your own system. It’s the only one you’ll be able to follow.

Stick to your system! Don’t throw things overboard when in drawdown.

Be curious, open-minded and always keep on learning.

Be ready for the outlier event. Do all the trades to make sure you don’t miss it.

Accept randomness and become comfortable with uncertainty.

Understand that “I don’t know” is a great and honest answer. In reality we know very little but tend to believe the opposite.

Process over outcome. Good decisions can result in losing trades and vice versa. Follow your rules, over and over and over again.

Fade the news. Talking heads…

Make mistakes, but learn from them so that every day you can make a new one.

You can control your position size, but not the outcome of the trade.

Keep things a simple as possible and avoid unnecessary complexity in your thinking or system design.

One entry, one stop-loss, one exit.

Don’t let schooling get in the way of your education.

Risk and volatility are not the same. Volatility can be a good thing. It goes both ways and can increase your returns.

Good trading is driven by consistency, discipline, and patience.

Only you are responsible for your trading. Never blame the market or somebody else.