Yesterday, I had the pleasure of joining Jeff Malec on RCM's "The Derivative" podcast where we discussed elements of my journey into systematic trend trading and the many missteps I took along the way. As you know, I believe it’s important to learn from past experiences to improve one's trading process over time, and I hope that this post can offer some valuable insights.

You can listen to the podcast here or watch it on YouTube here.

Taking a trip down memory lane and looking back at the period of 2003-2008, I recall being absolutely certain that I could come up with better systems than the existing CTAs, convinced that there had to be a better way.

Initially, I relied on a system that used a simple moving average and allowed only for long or short positions, without any room for neutrality. Unfortunately, my system suffered from inconsistent risk-taking as it didn't factor in ATR-based position sizing and stop rules. Instead of integrating these crucial components, I believed I could outsmart the competition and improve my vol-adjusted returns by adding ever more parameters to my entry and exit rules, which turned out to be a fallacy (and a rookie mistake).

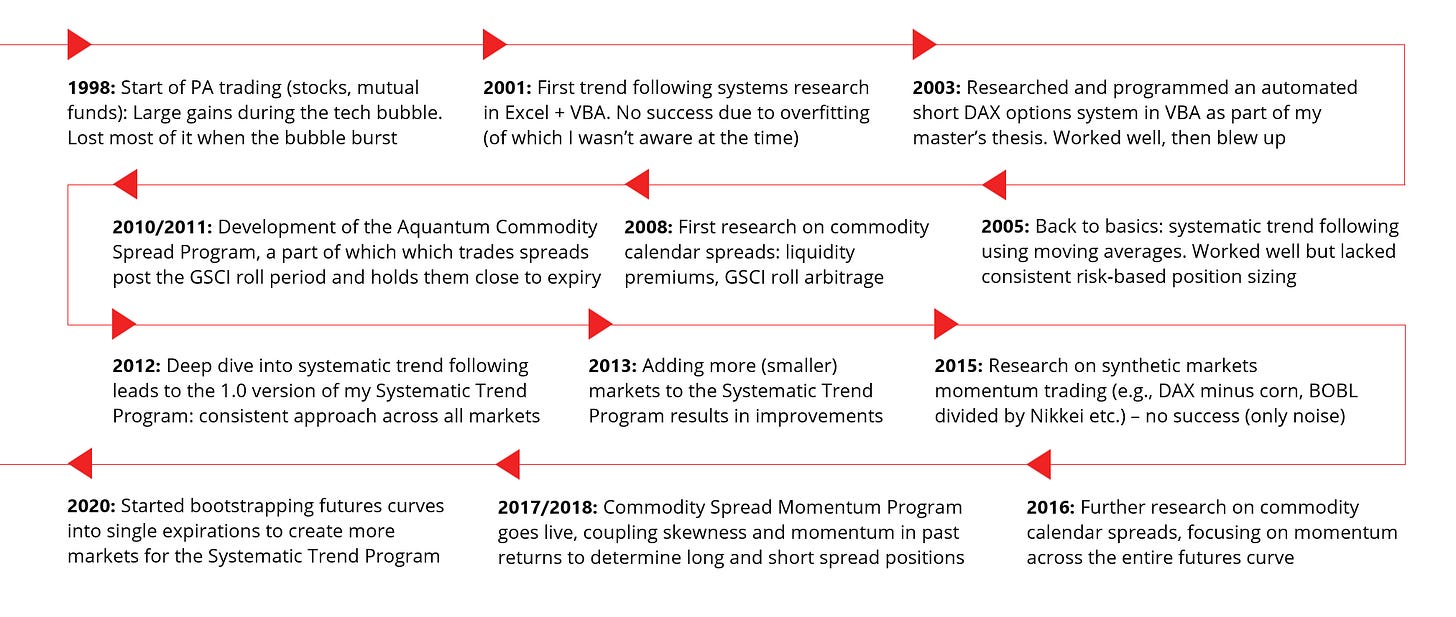

The image below shows how my research and trading evolved over time (it’s not 100% complete, but it shows some important milestones).

Although there is only one history in markets, there’s an almost endless number of time series we can create (e.g., through different time scales), and an almost infinite number of ways to analyze them (statistical analysis, technical analysis) and calculate valuation metrics (fundamental analysis). These methods can be broken down even further:

Technical analysis: support & resistance, head and shoulders, triangles…

Statistical analysis: patterns, regressions, breakouts, moving averages, MACD…

Fundamental analysis: Price-to-book, EBITDA, dividend yield…

With so many options available, it's easy to enter the world of data mining – which is a world of self-deception where the “discovery” of spurious correlations in historical data is an everyday normality. Systems born in that world are almost certain to fail in live trading, which upsets the inventor who doesn’t know better.

What’s the best method of staying away from that world? Real trading experience and good, old sample size. As you build live trading experience, you start to realize — through losses and pain — that the more parameters and rules you add to a system, the more dependent it becomes on the minutiae of historical data, which reduces its resilience and ability to handle unknown future data. That’s the best way to stop and reconsider.

Another very important feature that can only be developed on the back of live trading experience is trust — trust in your process, and trust in your system.

In my case, the development of what I call “system trust” was an emotional process. It cannot be achieved through paper trading, as running a system in simulation mode doesn’t replicate the emotions and pressures of live trading. Your true relationship with a system commences when you set it live, when the rubber meets the road, when the going gets tough, and when your feelings kick in. In a strange way, you want to turn yourself into a professional loser. Once you can view and love your losses as direct consequence of your resilient trading process, you’re probably at the point where you trust your system.

Many believe that adopting a rules-based, systematic trading process is a way to remove all emotions from trading. However, the reality is that being emotionless when trading and taking losses is difficult — impossible even. Today I understand that experiencing and learning how to cope with these emotions is essential in the process of building trust in one’s system. Can you stick to your system when it’s painful to do so? System trust is what enables you to stay the course.

Different traders have various methods to cope with losing periods, such as taking a break, doing more research, or trading smaller. However, if you abandon your system for good, it means you don't or can’t trust it, and/or that you traded with too much risk. It takes a lot of time and research to design a system that works for you — a system that you’ll be able to follow, love, and stick to during difficult times. The quest is to develop a system that’s able to weather the many storms of our markets so that you can survive as a trader and increase your odds of long-term success. Resilient systems, based on large sample size of trades and without too many complexities, tend to be stormproof, and that’s what you want to focus on first and foremost.

I agree 100%

Your newsletter recommended the macro compass from someone who has been accused of plagiarism. I unsubscribed.