Drawdowns are detrimental, not only for your finances but also for your psychological well-being. Research indicates that traders tend to underperform after a market crash and adjust their behavior in subsequent potentially risky scenarios. Those who anticipate a more negative response to financial loss often experience heightened fear in situations where losses are possible. Conversely, maintaining neutrality during a crash is associated with better performance.

Interestingly, the same principle applies to monetary gains. Individuals with intense emotional reactions to both gains and losses tend to exhibit significantly worse trading performance. In Quantitative Trading, neutrality is enforced by allowing computer code to make decisions. However, since these systems are designed by humans, emotions—both theirs and their investors'—can still influence outcomes.

Yet, with proper instruction and practice, traders can balance different personality traits. However, this doesn't guarantee immediate success; extensive training can't compensate for other factors contributing to poor trading performance. Nonetheless, maximizing your chances involves being adequately trained, gaining trading experience, and utilizing effective systems. As emphasized on this blog, employing robust systems significantly reduces the risk of errors in various aspects such as position sizing, defined exits, and risk management.

For investors, the approach differs slightly. Individual managers or positions may encounter significant drawdowns. Unlike institutional investors, non-institutional investors often lack strict risk limits, relying instead on a combination of statistical analysis, charting, and emotional judgment to assess positions. Position liquidation or risk reduction is likely more discretionary and once you missed the exit you might wonder how long you should be nursing your losses before calling it a day.

Consider the scenario of a drawdown lasting 35 years. This was exemplified by the Nikkei 225, which took approximately 35 years to recover from its low in 1989 (as highlighted in this recent article by Blueprint Investment Partners). On Feb 5th 2024 the Nikkei had worked its way out of a Drawdown that started Jan 5th 1989 (you know you’re in trouble if the underwater curve of your performance chart overlaps with it).

Such prolonged drawdowns can severely impact investors, especially those who entered the market later in life. According to research from Janus Henderson, on average men and women start investing around the age of 35, respectively 32. If you’re a 65 old retiree who made the decision to invest in the Nikkei at around that age, you were in for quite a ride. While buying at market lows or averaging investments over time may alleviate some concerns, enduring decades-long drawdowns can test even the most resilient investors. I guess after 14 years of drawdown in 2003 even the most disciplined investor might have cancelled their savings plan.

Another interesting example is the NASDAQ 100 Index. Everyone’s tech darling had a pretty ugly stretch from March 2000 until July 2016 (a bit shorter if you use total return data, which I didn’t because this is all based on free Yahoo finance data). For some mysterious reason, many websites like to show this chart starting only in 2007.

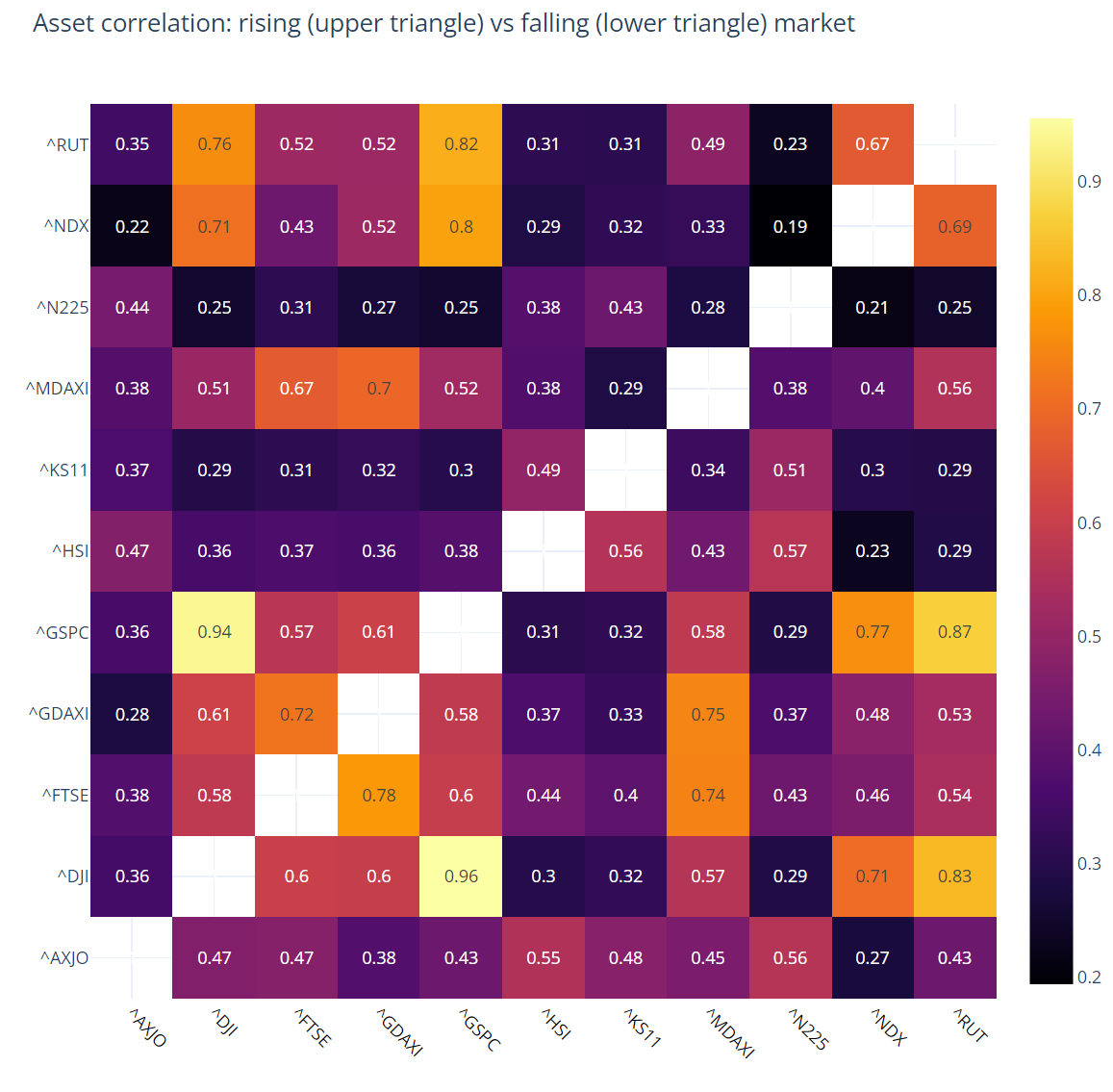

Diversification is often touted as a solution to reduce portfolio risk. However, its effectiveness in easing drawdown pain depends on various factors. Stock markets, for instance, exhibit interconnectedness, with correlations between different equity markets increasing during crisis episodes. While adding assets with low correlation can reduce portfolio volatility, correlations may rise during crises, limiting the effectiveness of diversification strategies.

The matrix below highlights international equity index correlation during rising (upper triangle) and falling (lower triangle) market environments since 1996. Unsurprisingly, markets in the same region have a tendency to be more correlated with markets in the same region (e.g. S&P = ^GSPC and NASDAQ = ^NDX). Even in this very simplified analysis, there is a tendency for correlations being slightly larger in falling markets.

Examining the maximum duration of being underwater across the aforementioned indices, it's evident that the Nikkei (^N225) fares the worst, enduring 12,466 days. Following closely is the NASDAQ, with 5,697 days, trailed by the FTSE with 5,529 days, and the S&P/ASX200 (^AXJO) with 4,286 days. Interestingly, the German DAX and MDAX indices fall within the mid-range regarding the longest drawdown, lasting 2,610 and 1,924 days, respectively. Considering how frequently Germans like to complain about these indices, I would’ve expected much longer periods. However, it's crucial to acknowledge that small but frequent drawdowns can still inflict significant harm over time. You can die a slow death by a thousand cuts just as painfully.

You might raise an objection: "Hold on a moment, these correlations don't seem too detrimental. Surely, all these markets can't be experiencing drawdowns simultaneously." And you'd be correct. By examining the five longest drawdown periods of each index since January 2000 and analyzing the frequency of each index being in one of those periods, we find that only about 20% of the time are ALL indices concurrently experiencing one of their five longest drawdowns. In approximately 67% of instances, more than half of the indices are in drawdown mode. Remarkably, 99% of the time, at least one index is undergoing a drawdown.

This shouldn’t come as a big surprise though. At least since the excellent presentation By Robert Frey (a former quant at Jim Simons legendary hedge fund) titled “180 Years of Market Drawdowns” we know:

“Stocks don’t make new highs every single day, so most of the time you’re going to be underwater from your portfolio’s high water mark. This means there are plenty of chances to be in a state of regret when investing in stocks.”

Research suggests that crisis propagation across different asset classes is weaker than within the same asset class. Therefore, diversification by adding assets similar to those already in the portfolio may not effectively mitigate drawdowns. Instead, investors should consider diversifying with assets that behave differently during market downturns, thereby reducing overall portfolio risk.

Despite the historical positive correlation between stocks and bonds in the 1970s, 80s, and 90s, you might consider allocating to bonds and constructing a traditional 60/40 portfolio. Alternatively, you may favor gold, which surprisingly offers a similar outcome to adding bonds in the 60/40 portfolio, as highlighted by Meb Faber recently. Or, if you prefer, you might explore quantitative long-short strategies and trend following—although this is entirely unrelated to Takahē Capital.

Regardless of your choice, it's essential not to wait until day 12465 of a 12466-day drawdown to act. After all, just as in medicine, prevention is the best cure.

#happytrading

I didnt really understand what the drawdown curves show. Would be interesting to see the performance of people who kept investing. In Japan for example last 10 years.anyhow seems like I should get bullish the DAX