𝐂𝐨𝐩𝐩𝐞𝐫: 𝐓𝐚𝐫𝐢𝐟𝐟𝐬, 𝐓𝐫𝐞𝐧𝐝 𝐒𝐢𝐠𝐧𝐚𝐥𝐬 & 𝐂𝐚𝐮𝐭𝐢𝐨𝐧 𝐀𝐫𝐨𝐮𝐧𝐝 𝐏𝐨𝐬𝐢𝐭𝐢𝐨𝐧𝐢𝐧𝐠

Hot Metal, Cold Feet?

Trump’s proposed 𝟓𝟎% 𝐭𝐚𝐫𝐢𝐟𝐟 𝐨𝐧 𝐜𝐨𝐩𝐩𝐞𝐫 𝐢𝐦𝐩𝐨𝐫𝐭𝐬 sent U.S. COMEX copper futures soaring to record highs yesterday—while 𝐋𝐌𝐄 𝐚𝐧𝐝 𝐒𝐡𝐚𝐧𝐠𝐡𝐚𝐢 𝐩𝐫𝐢𝐜𝐞𝐬 𝐚𝐜𝐭𝐮𝐚𝐥𝐥𝐲 𝐟𝐞𝐥𝐥, highlighting how local policy shocks can create major distortions in a globally traded commodity.

𝐒𝐨, 𝐰𝐡𝐲 𝐭𝐡𝐞 𝐝𝐢𝐯𝐞𝐫𝐠𝐞𝐧𝐜𝐞?

The tariffs directly target U.S. imports, driving a scramble for COMEX contracts as traders price in potential future supply constraints—even though COMEX warehouse inventories are currently high, suggesting no immediate physical shortage.

Meanwhile, global markets (LME, SHFE) still reflect softer physical demand, especially from China and Europe, where manufacturing activity has slowed.

Add to that a surge in speculative buying on COMEX, particularly from trend followers and CTAs reacting to price momentum.

Arbitrage between markets usually narrows these gaps, but tariffs and policy uncertainty make that harder in the short term.

Yet beneath the headlines, the long-term copper story hasn’t changed much: electrification, renewable energy buildout, and infrastructure upgrades continue to drive structural demand. But it’s been anything but a smooth ride.

𝐖𝐡𝐚𝐭 𝐀𝐛𝐨𝐮𝐭 𝐏𝐨𝐬𝐢𝐭𝐢𝐨𝐧𝐢𝐧𝐠?

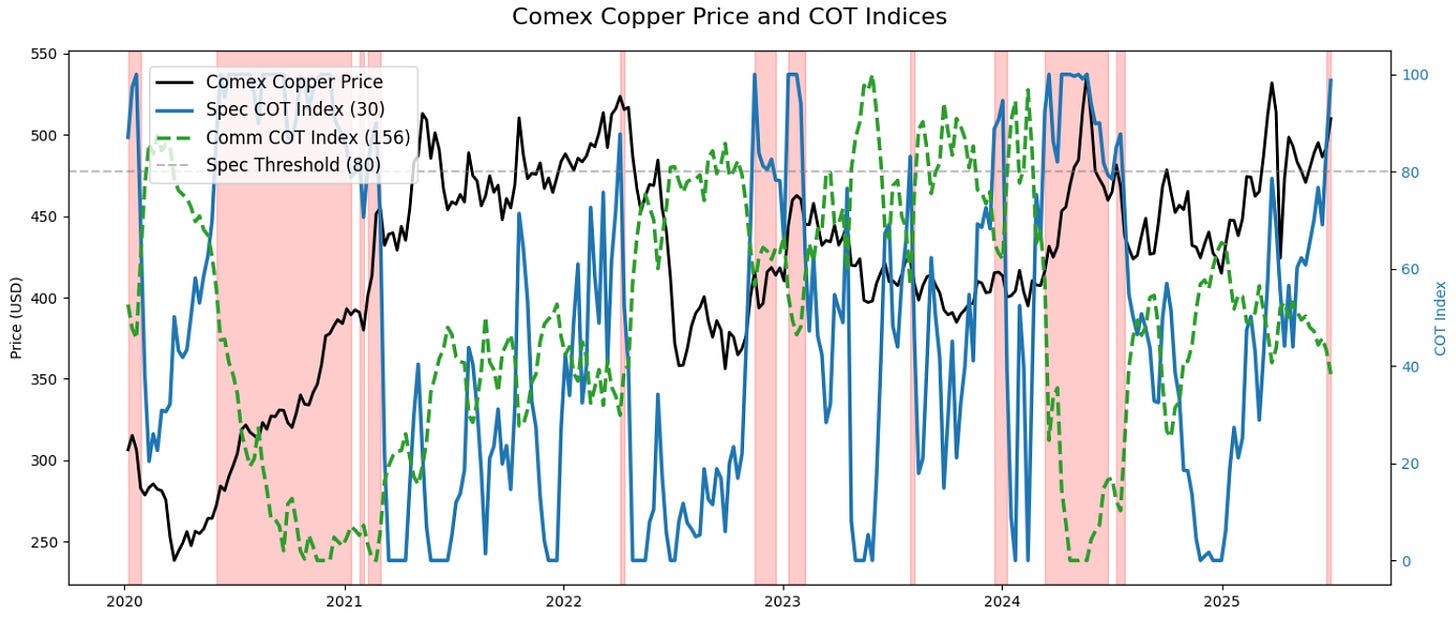

Interestingly, some reports point to CTA positioning shifting sharply more bullish, based on the COT Index now exceeding speculative thresholds. It’s tempting to see this as confirmation of the trend, but worth adding a few caveats:

The COT Index in its simple form covers only U.S. futures (COMEX), and excludes options—which may hide hedges or other directional bets.

Global flows (LME, SHFE) tell a different story, with prices falling and positioning possibly lighter.

And the COT data doesn’t differentiate between true trend-following exposure and shorter-term speculative or spread trades.

Still, these shifts matter. Quick changes in positioning often reflect market participants re-evaluating risk/reward, whether based on fundamentals like tariffs or simply following price action.

At Takahē Capital®, copper has been an fascinating market for us—both in our long-term trend systems and in our spread strategies, where shifts across the futures curve offer additional signals beyond outright price moves. If you want to learn more about our funds, please reach out to Moritz Seibert or myself and visit takahe.capital.